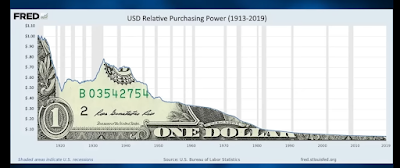

Lynette Zang is Chief Market Analyst at ITM trading Co. The company trades in gold and silver and is based in Pheonix Arizona USA. Zang says that all currencies have a lifetime with recognisable patterns that happen along the way. At the moment there is only about $0.03 (three US cents) purchasing power left from the $US Dollar of the year 1913.

|

| $0.03 cents purchasing power remaining |

With the Dodd Frank Act of 2010, if you get down to zero cents purchasing power then the banks have to use "your" money that you deposited with them, in a process known as a "Bail in" (as opposed to a "bail out" where Government puts up the money to save a bank). Legally speaking, when you make a deposit to a bank, you are loaning your money to the bank and you are an unsecured creditor. Most of the revenue made by banks at the moment is trading revenue and they get to gamble (by trading on stock exchange) with your money. Similar rules apply in the UK.

The USA abuses it's reserve currency status and exports inflation. It imports all the stuff it wants to enjoy, and in return gives dollars which are becoming increasingly valueless. Thus we have BRICS (see my earlier blog), and countries like Saudi Arabia accepting other currencies.

Why we should be concerned that banks will "bail in" .

First thing to remember is that Governments and Central banks caused inflation to rise by printing too much money (quantitative easing). But in an attempt to control things, Central Banks like the Federal Reserve and Bank of England raise Interest rates to make it more expensive to borrow , and therefore consumers purchase less, which forces prices down and consequently lowers inflation.

One of the problems with the banking system is that it is based on debt, and since the financial crisis of 2008 when trading banks got into difficulty, confidence in currencies and the banking system has reduced. In 2013 the European Central Bank noticed that Cyprus was requesting more banknotes than it appeared to need, and also that French and German Banks were taking money out of Cyprus.

When there are noticeable shifts in patterns like this, it means that change is coming. In the Cyprus example the banks closed and then gave savers a 10% "haircut" of the money in saving accounts. The ordinary saver was unaware of what was happening as the banks have a policy to manage perceptions so as not to cause a run on the bank (ie everyone wanting to withdraw their money at the same time). You can see the discussion amongst bankers for yourself in this YouTube video the FDIC meeting of 9 Nov 2022.

The Federal Deposit Insurance Corporation (FDIC) insures savers deposits. In the YouTube video you see their meeting on Wed 9th Nov 2022. If you look at video time:

- 1hr 24mins 44seconds: The discussion indicates that the group thinks that some information is better kept for professional investors as people have a short attention span and like tweets.

- 1hr 35mins 30seconds: You can see the discussion confirming that bail ins will happen " It's important that people understand that they can be bailed in , and they are going to be"

What happens with regard to investor's money?

Any transition to a new system would start on a Friday, over the weekend. The bank first rakes in the money of all investors who have £250,000 or more, and issues the investor with shares in the failing bank. But everyone risks being bailed in.

In india in 2016 the Government demonetised their notes. All of a sudden people had 48hrs to convert a limited amount of notes before they become worthless.

Possible bank failures in June 2023 due to move away from LIBOR.

Lynette Zang mentions London Interbank Offered Rate (LIBOR). This is a bench mark interest rate which is used in many banking contracts. Confidence in LIBOR was knocked by a scandal in 2012 involving collusion and price fixing. So on 30th June 2023 there will be a switch over to Sterling Overnight Index Average (SONIA), and a similar system in the USA: Secured Overnight Financing Rate (SOFR). LIBOR and SONIA / SOFR are different calculations and therefore trillions worth of contracts will be revalued . Zang worries that this may cause a crisis / crash which may lead to the introduction of Central Bank Digital Currency (CBDC) and a surveillance economy. Currency will be programmable to expire, and every single transaction that we make will without exception be monitored.

Inflation is the thing that risks destroying the public's faith and trust in the currency, and in Central Bank's ability to control it. The bank's tools include the "printing" of more money, and raising interest rates. But, to use the USA as an example, they have already increased national debt from $Billions to $Trillions. And businesses and public have many debts which, if they raise interest rates too high or too fast, will make them go bust.

One analogy that Zang mentions is like a borrower who knows he is going to go bankrupt, and has no intention of paying his debt and so loads up the credit cards before his financial world crashes. The central banks only need to keep the system going long enough to buy time to set up a new system.

Bank of England describes the changeover.